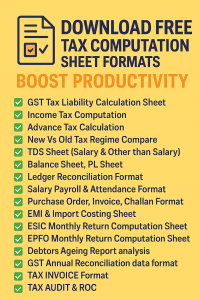

Download Free All Tax Computation Sheets Format to simplify GST, Income Tax, TDS, Advance Tax, Payroll, Ledger, ESIC, EPFO, and Accounting workflows. Boost productivity with 100% accurate, easy-to-edit Excel formats specially designed for tax professionals and accountants.

Introduction

Managing tax filings, GST reports, monthly returns, payroll, and accounting statements is a challenge for every business and tax professional. The process becomes even more stressful when calculations are done manually, increasing the risk of errors, delays, and compliance issues.

To solve these problems, professionals rely on accurate and ready-made Tax Computation Sheet Formats that simplify complex calculations in minutes. These sheets are designed to reduce workload, improve accuracy, and boost productivity instantly.

If you’re looking for Free Tax Computation Sheet Formats, you’re in the right place. This blog provides all essential GST, Income Tax, TDS, Payroll, ESIC, EPFO, Ledger & Reconciliation formats—completely free to download.

Download Free All Tax Computation Sheet Format – Boost Productivity

Accounting and tax compliance is the backbone of every business—whether small, medium, or enterprise. With frequent changes in GST laws, Income Tax rules, TDS rates, ROC filing requirements, and payroll structures, professionals need accurate tools to manage daily operations. One of the best ways to reduce workload and maintain accuracy is by using Tax Computation Sheet Formats.

These ready-to-use Excel sheets help in automating complex tax and accounting calculations within seconds. They eliminate human errors, save time, and bring efficiency to your workflow. In this article, we provide a complete list of Free Tax Computation Sheets along with their benefits, importance, and usage guide.

Why Tax Computation Sheet Formats Are Essential?

Tax and accounting tasks involve:

✔ Multiple calculations

✔ Data reconciliation

✔ GST filing

✔ Payroll management

✔ Monthly returns

✔ Annual tax compliances

Doing these tasks manually can be:

❌ Time-consuming

❌ Prone to mistakes

❌ Difficult for large datasets

❌ Stressful during deadlines

This is where ready-made Tax Computation Sheets play a major role. They simplify the entire workflow through:

-

Pre-built formulas

-

Automated calculations

-

Easy reconciliation

-

Accurate reporting

These sheets are suitable for beginners, accountants, tax consultants, small businesses, freelancers, CA firms, and corporates.

Complete List of Free Tax Computation Sheet Formats

Below is the detailed list of included formats along with explanations:

1. GST Tax Liability Calculation Sheet

This sheet helps you calculate GST Output, Input Tax Credit (ITC), and Net GST Payable. It includes:

-

GSTR-1 & GSTR-3B tax breakup

-

ITC reconciliation

-

Monthly GST payable summary

-

Automated formula for CGST/SGST/IGST

2. Income Tax Computation Format (Excel)

Perfect for:

✔ Salaried individuals

✔ Business owners

✔ Freelancers

Features include:

-

Taxable income calculation

-

Deductions under Section 80C, 80D, 80G

-

Rebate u/s 87A

-

Auto calculation of tax liability

3. Advance Tax Calculation Sheet

This helps businesses and professionals compute quarterly tax payments:

-

15% by June

-

45% by September

-

75% by December

-

100% by March

It prevents interest under Sections 234B & 234C.

4. New Vs Old Tax Regime Comparison Sheet

Easy comparison of both regimes based on:

-

Slab rates

-

Deductions

-

Total tax payable

-

Choosing the best option

5. TDS Sheet (Salary & Other Than Salary)

Covers TDS under sections:

-

192: Salary

-

194C: Contractor

-

194J: Professional fees

-

194H: Commission

-

194I: Rent

Auto-calculates monthly & yearly TDS.

Download FREE:- 10,000+ n8n Workflows Mega Pack

6. Balance Sheet & Profit Loss Sheet (P&L)

This sheet is perfect for small & medium businesses.

-

Auto P&L

-

Asset & Liability summary

-

Net profit calculation

7. Ledger Reconciliation Format

Used for vendor & customer ledger matching.

Helps identify mismatches, pending invoices, and balances.

8. Salary Payroll & Attendance Sheet

Includes:

-

Attendance tracking

-

Overtime

-

Leave management

-

Salary breakup (HRA, DA, Basic, Allowances)

-

Payslip generation

9. Purchase Order, Invoice & Challan Formats

Professionally designed formats for:

✔ Purchase Order

✔ Tax Invoice

✔ Delivery Challan

✔ Proforma Invoice

10. EMI & Import Costing Sheet

Calculate:

-

EMI payments with interest

-

Import duty

-

Landing cost

-

IGST on imports

11. ESIC Monthly Return Computation Sheet

Includes:

-

Employee contribution

-

Employer contribution

-

Auto summarization

-

Error-free submission

12. EPFO Monthly Return Computation Sheet

Covers:

-

PF employee share

-

PF employer share

-

Pension fund

-

Monthly return report

13. Debtors Aging Report Analysis Sheet

Shows overdue invoices by:

-

0–30 days

-

31–60 days

-

61–90 days

-

90+ days

Helps identify bad debts.

14. GST Annual Reconciliation Format

Useful for GSTR-9 & GSTR-9C.

Matches:

-

Turnover

-

Tax paid

-

ITC claimed vs ITC available

15. TAX INVOICE Format

Includes:

-

GSTIN fields

-

HSN/SAC

-

Item details

-

Tax breakup

-

Signature area

16. TAX AUDIT & ROC Format

Useful for:

-

Tax audit checklist

-

3CD analysis

-

MCA annual filing formats

Who Should Use These Free Tax Formats?

These formats are ideal for:

✔ CA & Tax Professionals

✔ Accountants

✔ Business Owners

✔ Tax Consultants

✔ Freelancers

✔ GST Practitioners

✔ Payroll Managers

How These Sheets Boost Productivity

These sheets help you:

✔ Save 80% of manual work

✔ Increase accuracy

✔ Prepare reports faster

✔ Avoid tax penalties

✔ Stay audit-ready

Conclusion

Tax compliance doesn’t have to be difficult. With free, ready-to-use Tax Computation Sheet Formats, you can simplify calculations, improve accuracy, save time, and boost overall productivity. Whether you’re handling GST, Income Tax, Payroll, Accounting, ESIC, EPFO, or Audit—these formats have everything you need to streamline your workflow.

❓ Frequently Asked Questions (FAQs)

1. Are these Tax Computation Sheets free?

Yes, all formats are completely free to download and use.

2. Can beginners use these sheets?

Absolutely! They are designed for both beginners and professionals.

3. Are the formulas already included?

Yes, all Excel sheets include pre-built formulas.

4. Can I edit and customize the sheet?

Yes, all sheets are 100% editable.

5. Are these formats suitable for businesses?

Yes, they are ideal for small, medium, and large businesses.

Download Free Tax Computation Sheet Format – Boost Productivity

Access free GST, Income Tax, TDS, Payroll, Ledger, Audit & Accounting Excel formats and improve productivity instantly.